Show content of Abs, Hermann J.

| Biographical data: | 15.10.1901 in Bonn - 05.02.1994 in Bad Soden |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1938-1967 (Spokesman 1957-1967) and Chairman of the Supervisory Board 1967-1976 Honorary President 1976-1994 |

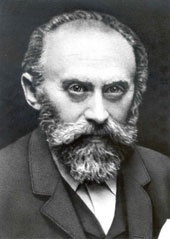

When Georg von Siemens, the leading figure in the foundation of Deutsche Bank, died in 1901, Hermann J. Abs was born. Together with Konrad Adenauer; Ludwig Erhard; Wilhelm Vocke, the President of the Bank deutscher Länder; and Hans Böckler, the trade union leader; Hermann J. Abs was one of the five Germans who became identified with the reconstruction of the Federal Republic of Germany after the Second World War.

Born on October 15, 1901 in Bonn, Hermann J. Abs grew up in a very strict Catholic Rhineland family in a upper middle class environment that was influenced by a certain degree of resentment against the Prussians.

His talents were such that he could very easily have become a mathematician or conductor. But he preferred, after finishing his schooling, to complete an apprenticeship at the Bonn-based privately owned bank of Louis David.

After working abroad in Amsterdam, London, North and South America, he started his career as a private bankier with one of the most important Berlin-based private banks, at "Delbrück Schickler & Co.". In January 1938, Abs joined the Board of Managing Directors of Deutsche Bank, seeing as he saw a greater opportunity for his own career development here than with a privately owned bank.

During the National Socialist period, Abs was responsible at the bank for its foreign business and, such being the case, he came into contact with the aggressive expansion policies of the regime. He, however, attempted to maintain his distance to National Socialism and never joined the party. But Abs was not a hero. When asked in a personal discussion about his relationship to National Socialism, he frankly expressed one single word: "fearful".

Recently, there has been a heated debate among historians on the role Abs played during the National Socialist period.

However, Hermann J. Abs' most important period was after the Second World War following a brief imprisonment by the Allies when he was involved in the reconstruction of Germany. In 1948 he participated in the establishment of the Bank deutscher Länder and, in November 1948, founded the Reconstruction Loan Corporation (KfW), which administrated the funds from the Marshall Plan. His political masterpiece, however, was during the negotiations on German foreign debt in London. With the London Debt Agreement of 1953, Germany's creditworthiness was re-established abroad.

During this same period at the beginning of the fifties, he worked towards the reunification of the German big banks that had been broken up following the Second World War. These efforts were successful in 1957, and Abs became the first Spokesman of the reunited Deutsche Bank, a position he held until 1967. During this period, he strengthened Deutsche Bank's contacts with industry and re-established old relationships in foreign trade.

From 1967 to 1976, Abs was Chairman of the Supervisory Board of Deutsche Bank. Alongside his work as a banker, Hermann J. Abs always had an involvement with art. He was Chairman of the Administration of the Städel Art Museum in Frankfurt am Main, Chairman of the Board of Trustees of the Patrons' Association of the Alte Pinakothek in Munich and Chairman of the Beethoven-Haus Society in Bonn. In 1991 he was a founding member of the Historical Association of Deutsche Bank. Hermann J. Abs died on February 5, 1994.

Show content of Achleitner, Paul

| Biographical data: | 1956 |

| Institution: | Deutsche Bank |

| Functions: | Chairman of the Supervisory Board of Deutsche Bank 31 May 2012 - 19 May 2022 |

Show content of Ackermann, Josef

| Biographical data: | 1948 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1996-2012 (Spokesman 2002-2006, CEO 2006 - 31 May 2012) |

Show content of Adelssen, Anton

| Biographical data: | December 18, 1824 in Koenigsberg - June 29, 1898 in Berlin |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1898 |

see Cohn, Anton

Show content of Albrecht, George

| Biographical data: | 02.08.1834 in Hannover - 24.11.1898 in Bremen |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1898 |

The merchant from Hanover was one of the three Bremen founding draftsmen who were won over for an investment at Deutsche Bank in 1870. He contributed 50,000 thalers. The Bremen shareholders (in addition to Albrecht, these were Hermann Heinrich Meier and Alexander Georg Mosle) were not on the primary list of draftsmen, possibly they had only been able to interest the initiators of the foundation in the project of a German bank to finance foreign trade a short time before the foundation. Albrecht's commitment was represented by the aforementioned Meier, who was involved in the founding process and possibly opened the door for those involved in Bremen. A connection to Bremen's foreign trade center was extremely important for the new bank, for which international trade finance was to become an important business area.

Albrecht was a partner in Johann Lange Sohn’s Wwe. & Co. in Bremen. He headed the traditional shipping company, which also operated as a trading house, until his death in 1898. The company was active in the import and export business with countries in Western Europe, America and Africa and traded in wool, among other things. Albrecht himself was also active in the Bremen textile industry, he sat on the administrative board of the Bremen wool combing and in the association of Bremen wool merchants. In 1864 he married the daughter of the businessman Ludwig Knoop, who had become one of the leading entrepreneurs of his time through the textile trade and the establishment of a textile industry in Russia. Albrecht had been the Austro-Hungarian consul since 1895. Not only did he stay with Deutsche Bank as a member of the board of directors, to which he had been a member from the first meeting, until his death, but he was also deputy chairman of the local committee of the Bremen branch, which had opened in 1871.

In addition to everyday business, Albrecht was interested in geography; He was a co-founder of the Geographical Society in Bremen and financed various research trips, for example the second German North Pole expedition, in which he was even involved in the planning.

Show content of Bamberger, Ludwig

| Biographical data: | 22.07.1823 in Mainz - 14.03.1899 in Berlin |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Supervisory Board 1870-1872 |

Alongside Berlin private banker Adelbert Delbrück (1822-1890), politician, banker, and currency expert Ludwig Bamberger is considered an initiator and founder of Deutsche Bank. In Bamberger, Delbrück found a significant supporter of his plans "to create a large bank, primarily for overseas trade, which should make us independent of England and the credit facilities that German merchants could only find and seek in London." At that time, Bamberger was involved in various South American and East Asian credit transactions and was forced to process a large part of them through London. "These experiences," he later wrote in his 'Memoirs,' "provided the impetus that, when in the late 1860s, during my first longer stay in Berlin, Adalbert Delbrück, the head of the banking house Delbrück, Leo & Co., spoke to me about the venture of a Deutsche Bank to be founded, with the request to participate in its formation and organization, I willingly agreed, with a view to the expansion to be gained by the German banking system in transatlantic territories, for which I felt I possessed some knowledge."

Ludwig Bamberger, descended from Jewish banking families on both sides, completed his law studies at the universities of Gießen, Heidelberg, and Göttingen after attending grammar school in his hometown of Mainz, concluding them in 1845/47 with both state law examinations. The academic career he aspired to was interrupted by the Revolution of 1848/49, which Bamberger passionately supported as an orator and journalist – as a staunch representative of the political left. As a participant in the Palatinate uprising of May 1849, he had to leave Germany, fleeing first to Switzerland, then to Holland, England, and France. In absentia, he was sentenced to severe prison terms and, in 1852, even to death, "executable in the marketplace of the city of Zweibrücken." A trained lawyer, he initially planned to work as a lawyer abroad. However, since he was related to the Bischoffsheim banking family through his mother, he followed the family's advice and tried his hand at banking. His mother's two brothers, Louis and Jonathan Bischoffsheim, had founded banking houses in Amsterdam, Antwerp, London, and Paris, and Bamberger learned the trade from scratch, initially in London. As a sign of his adaptation to the new profession, the 'offensive' full beard, the symbol of the revolutionary, immediately disappeared: the change was so drastic that most of his acquaintances no longer recognized him at first glance.

In 1851, Bamberger founded his own banking house in Rotterdam, but it was not successful. After this sobering experience, he joined his uncle's Parisian firm as an authorized signatory, where he primarily acquired knowledge in overseas business, which would later prove to be of considerable benefit in founding a foreign trade bank. Among the most important experiences of these years was his involvement in the establishment of Banque de Paris et des Pays Bas, one of the two predecessor banks of Banque Paribas, which remains one of the leading French banks today. The events in Germany, the national unification movement he himself longed for, and the liberal change of course in Prussia prompted Bamberger to return in 1866. Already in exile, he had supported Bismarck's "Lesser German" policy, not least because it also helped the economic ideals of the liberals to achieve a breakthrough. As a representative of his hometown Mainz, he was elected to the Customs Parliament in 1868, a parliament of the Customs Union composed of representatives from the North German Reichstag and the South German states. Bismarck, who would later appoint Bamberger as one of the best experts on French affairs to be his personal advisor during the Franco-Prussian War of 1870/71, believed that through him he could gain influence over the liberal press, which remained little inclined towards the Chancellor. His proximity to Bismarck astonished Bamberger's democratic friends: "Oh Bamberger, formerly the boldest and sharpest pen of Hessian democracy, how old and weak you have become, after earning so much money as a banker with the champagne of bitter Parisian exile!" he had to endure public ridicule.

In 1869/70, Bamberger was involved in the preparation and founding of Deutsche Bank. The memorandum he drafted on behalf of the provisional administrative board and sent to Bismarck on February 8, 1870, lent additional weight to the application for the concession of the bank to be established and led to its success with the granting of the concession on March 10, 1870. The esteem Bamberger enjoyed among Deutsche Bank's founders was also evident in the fact that, although he subscribed to only 18,000 Thaler (out of a total of 5 million Thaler in share capital), he was given the first position on the list of initial subscribers. From 1870 to 1872, he was a member of Deutsche Bank's 24-member administrative board, which, as the 'bearer of all powers on behalf of the company,' was endowed with executive rights that went far beyond those of today's supervisory board.

After the founding of the German Empire in 1871, Bamberger was elected to the Reichstag, to which he would belong for more than two decades, until 1893. As a leading member of the National Liberal faction, he played a significant role in the unification of the German monetary system, the conversion from silver to gold currency, and the establishment of a German central bank, the Reichsbank, which commenced operations in 1876. In 1880, Bamberger joined the so-called Secessionists, who had separated from the National Liberal Reichstag faction in a dispute over Bismarck's demanded introduction of protective tariffs. Unlike their party colleagues who were willing to cooperate with the Imperial Chancellor, the Secessionists, who soon after renamed themselves the 'Liberal Union,' strictly rejected a protectionist economic policy supported by the conservative Reichstag majority, the Central Association of German Industrialists, and agriculture. This also marked the final break with the Chancellor. From 1883 to 1893, Bamberger was a member of the German Free-minded Party, which at times formed the largest faction in the Reichstag. When this party split again in 1893, he joined its right wing, the Free-minded Union, without, however, accepting another Reichstag mandate.

Numerous writings on monetary policy and other economic policy topics established Bamberger's high reputation as an economic theorist. His academic education, his political and journalistic connections, but above all his practical experience in politics and economics, predisposed him to contribute as a 'political advisor' to the founding of a national bank.

Show content of Bänziger, Hugo

| Biographical data: | 1956 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2006 - 31 May 2012 |

Show content of Bechtolf, Erich

| Biographical data: | 08.04.1891 in Elberfeld - 30.10.1969 in Hamburg |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1942-1945 and 1957-1959, Chairman of the Supervisory Board 1960-1967 |

Bechtolf's father was the municipal architect in Elberfeld. After studying law, he initially worked as a legal counsel for the Employers' Association before joining Deutsche Bank's Elberfeld branch in the same capacity in 1922. In 1925, he became branch manager in Hamm, and in 1928, he joined the Secretariat of the Berlin head office as a departmental director. After the merger with Disconto-Gesellschaft, in which he had participated as a legal advisor, Bechtolf moved to Hamburg in 1932 as branch manager, where he primarily cultivated business relations with major shipping companies.

From 1940, Bechtolf served as the German delegate on the Supervisory Board of the Dutch Deutsche Bank subsidiary Handel-Maatschappij H. Albert de Bary & Co. in occupied Holland. Bechtolf did not comply with the Nazi regime's desire for German major banks to incorporate leading Polish credit institutions during World War II, by "mustering the courage... to thwart the assigned takeover of Bank Handlowy through simple inaction" (Harold James). In 1942, he was appointed to the Management Board of Deutsche Bank, where he was responsible for the branch districts in the Rhenish industrial region and for Saxony. The Secretariat also fell within his remit.

At the end of the war, Bechtolf was sent by the Management Board to Hamburg to organize a relocation of the bank's central functions to the Western zones in case of a Russian occupation of Berlin. In February 1946, he was suspended from duty by the Allies but was able to resume his work in the "Leadership Staff" Hamburg from late 1947. During the period of the regional successor banks, Bechtolf was a member of the Management Board of Norddeutsche Bank in Hamburg. After 1957, he remained a member of the Management Board of the re-established Deutsche Bank for another two years. His important mandates included the chairmanship of the Supervisory Boards of Hoesch, Reemtsma Cigarettenfabriken, and Nord-Deutsche Lebensversicherungs-AG. At Deutsche Bank, after leaving the Management Board, he served as Chairman of the Supervisory Board from 1960 to 1967.

Show content of Bischoffsheim, Henry

| Biographical data: | 17.02.1829 in Amsterdam - 11.03.1908 in London |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1874 |

In the Supervisory Board of Deutsche Bank, Henri (later also Henry) Bischoffsheim represented his London-based banking house Bischoffsheim & Goldschmidt, for which Adelbert Delbrück acquired shares worth 75,200 talers on its behalf during the founding of Deutsche Bank.

Bischoffsheim belonged to a famous Jewish banking family that maintained close ties with the equally Jewish bankers Bamberger, Hirschs, Rothschilds, and Goldschmidt. His father, Louis-Raphaël Bischoffsheim, originally came from Mainz but moved early to Amsterdam and later to Antwerp, where in 1827 he founded the banking house Bischoffsheim & Goldschmidt with his brother Jonathan-Raphaël and Hayum-Salomon Goldschmidt. Further branches in Belgium, Germany, and France were to follow. The bank was also represented in London, where Henri Bischoffsheim emigrated in 1849 and soon took over the management of the London branch. It was also there that Ludwig Bamberger, one of the main initiators in the founding of Deutsche Bank and nephew of Louis-Raphaël, began his banking career. Under Bischoffsheim's leadership, the banking house operated on an international level, investing in various railway companies in Europe, railway construction in the USA, and government bonds of Latin American countries, Turkey, and Egypt. The bank was involved not only in the founding of Deutsche Bank but also in banks in Europe, the USA, and Constantinople. The best known of these are considered to be Banque de Paris et des Pays-Bas (Paribas) and Société Générale de l'Empire Ottoman. Due to some of these transactions, Bischoffsheim's house became the target of an investigative commission, as it was accused of reckless issues.

Bischoffsheim successfully managed the London bank until the 1870s, then handed over the management to Ernest Cassel and retired. Due to the initiative of his wife Clarissa, née Biedermann, their residence was a meeting point for London's high society. Both also cared for the welfare of the city's population, donated numerous social institutions, and founded and/or financed the ambulance service in London. Furthermore, the couple was strongly involved in the Jewish community and supported it with various donations.

Show content of Blessing, Werner

| Biographical data: | 23.04.1931 in Basel - 21.08.1987 on the Chiemsee |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1981-1987 |

The son of former Bundesbank President Karl Blessing learned the banking business after his high school diploma at the Hamburg private bank Joh. Berenberg, Gossler & Co. At Norddeutsche Kreditbank, he rose to deputy Management Board member before joining Deutsche Bank in 1965, where he initially worked in Hamburg as co-head of the branch there. With his move to the Frankfurt headquarters, he took over as Senior Group Director of Deutsche Bank, heading the International Department. In 1981, he was appointed deputy Management Board member, and in 1984, a full Management Board member. On the Management Board, he was responsible for international business, focusing on North and South America, South Africa, and Australia. Domestically, he was assigned the Hannover branch district. The international debt crisis was a major concern for him. He represented the German credit institutions in the New York bank coordination committees for Brazil and Mexico. At the Protestant Church Congress in Frankfurt in the summer of 1987, he explained the role of credit institutions, particularly in business with South Africa.

Show content of Blinzig, Alfred

| Biographical data: | 16.01.1869 in Stuttgart - 04.10.1945 in Bayreuth |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1920-1934 |

After his apprenticeship and five years of employment at Württembergische Vereinsbank in Stuttgart, Blinzig went to Brussels in 1892 for further training, and to London in 1894, where he worked for a longer period at the stock brokerage firm Nelke, Philipps & Bendix, but also for the London Agency of Deutsche Bank, so that he was no longer a stranger in Berlin when he joined the Secretariat of Deutsche Bank in 1899. In Arthur von Gwinner's department, he found the opportunity to develop his experience and skills in the technical execution of international financial transactions. In 1902, he was granted power of attorney. In 1904, he was appointed as an auxiliary member of the Management Board of Deutsche Treuhand-Gesellschaft. At the same time, he was significantly involved in the introduction of the Baltimore & Ohio Railroad Company's share on the Berlin Stock Exchange. The admissions office for foreign railway shares, established by the Stock Exchange Act of 1896, was still under development at that time. Blinzig was therefore sent to the U.S. to collect the necessary information for the prospectus on site.

After joining the Management Board of Deutsche Bank in 1920, Blinzig took over some of Arthur von Gwinner's responsibilities. His portfolio included, in addition to American financing and lending business, supervision of the branches in Silesia, East Prussia, Lübeck, Danzig, and Katowice, the deposit business, and administrative matters. In the 1920s, Blinzig advocated for the restitution of German property confiscated in the U.S.; during a stay in New York in 1927, he succeeded in convincing influential circles of the validity of the German arguments, thereby making an important contribution to the realization of the so-called "Freigabebill" (Release Bill). Blinzig represented Deutsche Bank on a large number of industrial supervisory boards, e.g., at Gesellschaft für elektrische Licht- und Kraftanlagen, where he held the chairmanship. The electricity industry and the insurance sector formed a preferred part of his area of work. From 1932 to 1939, he served as Chairman of the Supervisory Board of Philipp Holzmann AG.

Show content of Boehm-Bezing, Carl L. von

| Biographical data: | 20.05.1940 in Wroclaw - 23.01.2023 in Frankfurt am Main |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1990-2001 |

Carl-Ludwig von Boehm-Bezing was born in 1940 in what was then the East German city of Breslau – today’s Wroclaw in Poland. As the Second World War was ending, his family fled with him to Munich, where he then grew up. In 1961, he started studying law in Bonn, Cologne and Berlin and, having passed the second state examination in law, he joined Deutsche Bank as a trainee in 1969, initially working in the North Rhine-Westphalian cities of Viersen and Dusseldorf. In 1972, von Boehm-Bezing was appointed assistant to the then Management Board Spokesman Franz Heinrich Ulrich, who requested that von Boehm-Bezing spend time in Hamburg at the Deutsche Treuhand-Gesellschaft, an auditing and trust company, which was later to become KPMG. In 1976, von Boehm-Bezing was appointed a member of the management of the Braunschweig branch, and three years later he moved to the management of the Frankfurt am Main branch.

Appointed to Deutsche Bank’s Management Board in January 1990, von Boehm-Bezing was responsible for international business in Luxembourg, Switzerland and Latin America, and for domestic business in the regions Bielefeld and Mainz. Right at the beginning of his tenure on the Management Board, he was tasked with building the newly created private investment management division, which was later to become Deutsche Bank's Private Banking division.

As Management Board member responsible for corporates and real estate, he shaped Deutsche Bank's corporate banking business for many years, focusing especially on small and medium-sized companies, the so-called Mittelstand. It was also thanks to his initiative that investment banking products became more popular with Mittelstand clients. Von Boehm-Bezing also expanded the bank's business with the public sector and the use of complex loans and products.

In 1994, von Boehm-Bezing played a key role in the implementation of the financial restructuring concept for mining and metals company Metallgesellschaft, saving it from bankruptcy. He was not able to do the same thing for established German construction company Philipp Holzmann AG, of which he was Chairman of the Supervisory Board from 1997 to 2000. In May 2001, he resigned from the Management Board of Deutsche Bank at his own request.

Von Boehm-Bezing's cultural interests were manifold. Continuing an important commitment of Deutsche Bank, he supported important developments as chairman of the administrative committee of one of Germany’s oldest cultural institutions, the Freies Deutsches Hochstift. His name is closely linked with the German Romanticism Museum in Frankfurt, which opened in 2021. Furthermore, he was honorary chairman of Frankfurt Bach Concerts, chairman of the board of trustees of the Association of Friends of the Bach Week Ansbach and was a member of the board of trustees of the Frankfurt Radio Symphony.

Show content of Boner, Franz A.

| Biographical data: | 14.08.1868 in Emden - 05.07.1941 in Garmisch-Partenkirchen |  |

| Institution: | Disconto-Gesellschaft / Deutsche Bank | |

| Functions: | Joint Proprietor / Member of the Management Board 1922-1932 |

Franz Boner's family came from Emden, where his father worked in the shipping industry as a state-sworn average adjuster, as experts for the settlement of major marine casualties were called in port cities. Franz A. Boner, too, after studying law and earning his doctorate, continuing his father's professional tradition, was appointed a sworn average adjuster by resolution of the Bremen Senate. He held this office from 1891 to 1907. The focus on shipping and overseas trade also shaped the work of the banker, after he joined the management of the Bremen branch of Disconto-Gesellschaft in 1907, which had acquired the Bremen banking house Schultze & Wolde in 1904. In 1922, he became a joint proprietor of Disconto-Gesellschaft in Berlin and, in addition to the Bremen branch network, was responsible for managing cash flows. After the merger with Deutsche Bank, he took over the personnel department, where, during the significant job cuts resulting from the merger, he strived for socially acceptable solutions.

In 1932, Boner resigned from the bank's Management Board and, though only for one year, joined the Supervisory Board. From 1934 to 1939, however, he still served as Chairman of the Advisory Board Berlin-Brandenburg of Deutsche Bank.

Boner embodied the type of calm and persistently pursuing organizer who primarily dedicated himself to internal work.

Among the special achievements that also made his name known to a wider public was his activity in the linoleum industry. With the significant involvement of Disconto-Gesellschaft, Deutsche Linoleum-Werke AG was founded in 1926, representing a consolidation of most of the domestic plants in this industry sector. Boner held the chairmanship of its Supervisory Board for many years. In this capacity, he also participated in the establishment of Continental Linoleum-Union, Zurich, a consortium comprising six European countries, in which Deutsche Linoleum-Werke AG was by far the most significant company. True to his background, Boner also dealt with the overseas interests of the German economy, including at Norddeutscher Lloyd, the steamship company Hansa, and, above all, at the Brasilianische Bank für Deutschland, founded by Disconto-Gesellschaft and Norddeutsche Bank.

Show content of Bonn, Paul

| Biographical data: | 10.05.1882 - unknown |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1928-1930 |

Paul Bernhard Bonn came from a long-established Jewish banking family in Frankfurt am Main. After studying law, which he completed with a doctorate, he joined the Deutsche Bank branch in Frankfurt in July 1909. In 1911, he was granted power of attorney. In 1914, he became deputy director there. In the same capacity, he went to the newly established foreign representation of Deutsche Bank in Sofia in 1917, where he became full director a year later. After the First World War, he moved to the head office in Berlin. Together with Werner Kehl, he was appointed deputy member of the Management Board in 1926 and full member of the Management Board of Deutsche Bank in 1928.

Bonn primarily worked in foreign business, and particularly in Russian business. Thus, he involved Deutsche Bank in the Russian-German Transit Trade AG, founded in Moscow in 1923 under Russian law, which, however, soon operated at a loss. More successful was his role in connection with the large Russian consortia, in which Deutsche Bank had assumed a leading role since 1926. As an intermediary between banks and industry, Ifago (Industriefinanzierungs-AG Ost) had been established here, and Bonn was the only banking representative on its Supervisory Board.

Due to Deutsche Bank's participation in Osthandels-AG, driven by Bonn, the bank became involved in unprofitable commodity transactions. Consequently, Bonn had to leave the Management Board of Deutsche Bank in December 1930.

Show content of Börsig, Clemens

| Biographical data: | 1948 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2001-2006, Chairman of the Supervisory Board 2006 - 31 May 2012 |

Show content of Breuer, Rolf-E.

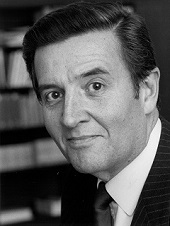

| Biographical data: | 03.11.1937 in Bonn - 22.05.2024 Frankfurt am Main |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1985-2002 (Spokesman 1997-2002), Chaiman of Supervisory Board 2002-2006 |

Rolf-E. Breuer started as a trainee at the Mainz branch of the then Süddeutsche Bank – one of the successor institutions of Deutsche Bank in the post-war years – and completed it in 1958 in the Munich branch of the re-established Deutsche Bank. After obtaining a doctorate in law, and internships at two local banks in London and Paris, he returned to Deutsche Bank in 1966. He initially worked in the credit business at the Karlsruhe branch. In 1969, he moved to the stock exchange department of the head office in Frankfurt and was promoted to lead it in 1974. In 1985, he was appointed to the Management Board of Deutsche Bank, where he remained responsible, among other things, for the stock exchange business. He strongly advocated the creation of a German futures exchange and initiated the debate on fully electronic stock exchange trading at an early stage. In 1997, Breuer succeeded Hilmar Kopper as CEO. During his term of office, which lasted until May 2002, the bank made its largest acquisition. The acquisition of Bankers Trust in 1999, strengthened Deutsche Bank’s position significantly in the US as well as on international capital markets. In October 2001, Deutsche Bank shares were listed on the New York Stock Exchange.

In 1999, Breuer started the foundation "Remembrance, Responsibility and Future," which provided five billion euros for victims of the Nazi regime, together with twelve other German companies and with the support of the Federal Government.

During his career, Breuer was particularly committed to strengthening Germany as a financial centre, which earned him the nickname "Mr Financial Centre". This commitment was also reflected in numerous positions: He was Chairman of the Supervisory Board of Deutsche Börse AG, Chairman of the Stock Exchange Council of the Frankfurt Stock Exchange, initiator and member of the board of Aktionskreis Finanzplatz e.V., a foundation promoting Germany as a financial centre, and President of the Association of German Banks. He was instrumental in the founding of the Centre of Financial Studies at the Goethe University Frankfurt, which was recognised in his appointment as honorary senator by the university in 2020. In 2005, the city of Frankfurt awarded him its badge of honour.

Breuer also made headlines with the failed merger with Dresdner Bank in 2000 and with an interview in 2002 that led to legal action by the media company Leo Kirch. He stood down as CEO in 2002 and gave up his mandate as Chairman of the Supervisory Board prematurely in 2006.

Breuer was a lover and connoisseur of classical music, art and literature, which was also reflected in his many cultural activities. In addition to his commitment to Frankfurt institutions such as the Alte Oper and the Kunsthalle Schirn gallery, he was also active for the Kulturstiftung der Länder, the Bachakademie in Stuttgart, the Akademie der Künste in Berlin and the Berliner Philharmoniker.

Show content of Brunswig, Peter

| Biographical data: | 19.06.1879 in Neustrelitz - 22.01.1953 in Bonn |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1933-1934 |

Peter Brunswig came from an old Mecklenburg family of pastors, doctors, and lawyers. His schooling in Neustrelitz was followed by law studies in Heidelberg, Berlin, and Rostock, which he completed with a doctorate in 1904. In the same year, he joined the secretariat of Deutsche Bank's Berlin headquarters. There, he primarily dealt with the financial aspects of founding and converting enterprises into other legal forms, as well as with industrial and municipal bonds. In early 1909, Brunswig went to Santiago de Chile, where he handled business with the Chilean government on behalf of Deutsche Bank and, in 1910, took over the management of the Santiago branch of Deutsche Ueberseeische Bank. In 1921, he returned to the Berlin headquarters as Senior Counsel. In 1926, he was appointed deputy member, and in 1933, full member of Deutsche Bank's Management Board. However, he left the bank the following year to join the Düsseldorf private bank C.G. Trinkaus as a personally liable partner.

After the Second World War, he took over the management of Rheinische Girozentrale und Provinzialbank as an interim board member and participated in the reorganization of the German monetary system as a member of the Joint German Financial Council in Frankfurt. He also made himself available for the preparations of the Securities Adjustment Act.

Peter Brunswig died in a car accident.

Show content of Burgard, Horst

| Biographical data: | 28.01.1929 in Traben-Trarbach - 23.11.1999 |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1971-1993 |

Before Burgard turned to business administration, he initially studied English, history, and philosophy. After completing his degree as a certified business administrator (Diplom-Kaufmann) in Cologne, he joined Deutsche Bank in 1956, where he worked until 1968 in several branches in the Rhineland – most recently as a director. In the interim, he earned his doctorate (Dr. rer. pol.). In 1970, Burgard was appointed Director with General Power of Attorney. He was appointed Deputy Member of the Management Board in 1971 and full Member of the Management Board in 1974. After his departure from the Management Board in 1993, the annual general meeting elected him to the Supervisory Board, of which he was a member until 1997. For almost two decades, Burgard had been responsible for the bank's human resources policy, a field that suited his inclination to handle delicate matters discreetly. His outwardly reserved demeanor concealed the significant internal impact Burgard had. For several years, he was also responsible for credit monitoring and thus for a significant part of the bank's risk management. His regional responsibilities included France, Belgium, the Netherlands, and domestically, the branch district of Frankfurt am Main. In addition, Burgard held numerous supervisory board mandates. In the cultural sector, Burgard was involved, among other things, as Chairman of the Administrative Committee of the Freies Deutsches Hochstift and the Association of Friends and Patrons of the University of Frankfurt.

Show content of Campelli, Fabrizio

| Biographical data: | 1973 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board since November 2019 |

Show content of Cartellieri, Ulrich

| Biographical data: | 1937 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1981-1997 |

Show content of Christians, F. Wilhelm

| Biographical data: | 01.05.1922 in Paderborn - 24.05.2004 in Düsseldorf |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1965-1988 (Spokesman 1976-1988), Chairman of the Supervisory Board 1990-1997 |

When the doctor of law Christians began his professional career at Deutsche Bank in 1949, this was intended to be just one step on the way to the Foreign Service. However, he was so interested in banking that he stayed at the bank and soon made a career after thorough training. After several years as a branch manager, he was appointed to the Management Board in 1965.

From 1976, Christians, first together with Wilfried Guth and then with Alfred Herrhausen, led the bank for twelve years as Spokesman of the Management Board and later from 1990 to 1997 as Chairman of the Supervisory Board. From 1975 to 1979, he held the office of President of the Association of German Banks.

During his time on the Management Board of Deutsche Bank, Christians, a native of Paderborn, was particularly committed to improving economic relations between East and West. In the early 1970s, his commitment helped the first German-Soviet natural gas pipeline deal achieve a breakthrough. The financial diplomat Christians was considered one of the best experts on Eastern Europe, whose advice was widely sought in business and politics. His commitment to international business led to Christians often being referred to as the "Foreign Minister" of Deutsche Bank.

Concerned about the chronic lack of equity capital in the German economy, Christians advocated early on for stock market listings of medium-sized companies and for the broad acceptance of shares as an investment instrument. Christians also showed a special commitment to art.

He initiated the first German-Russian cultural cooperation in the 1980s. Until his death, he was involved in numerous cultural institutions. For his dedication to business and culture, Christians received numerous honors and awards.

more information

Brought to Light - Documents pertaining to the history of Deutsche Bank [1]

Show content of Cohn, Anton (since 1881 Adelssen, Anton)

| Biographical data: | 18.12.1824 in Königsberg - 29.06.1898 in Berlin |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1898 |

One searches in vain for Adelssen or the banking house Adelssen & Co. on the list of subscribers to shares at the founding of Deutsche Bank. Anton Cohn signed there under his original name, which he dropped in 1881 to adopt his wife Anna's surname, spelled Adelssen. She, like Cohn himself, came from an originally Jewish family who had themselves baptized. Her father Jacob Ludwig Adelson was a successful merchant and Russian consul; Anton himself was appointed Greek consul in 1884.

The banking house Cohn, Bürger & Co. in Berlin, which is listed under this name as a subscriber to shares at the founding of Deutsche Bank, became Adelssen & Co. through the name change. Adelssen only retired from Deutsche Bank's Board of Directors upon his death in 1898. At its founding, he had acquired shares for his banking house worth nominally 141,000 Thalers and had been elected a member of the Board of Directors at the first general meeting. He was also a member of the first auditing commission mentioned in the bank's annual report for 1872. His bank was also involved in the founding of the Nationalbank für Deutschland and, as a sub-participant of Deutsche Bank, in the founding of the Berliner Bankverein.

Show content of Cohrs, Michael

| Biographical data: | 1956 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2009-2010 |

Show content of Craven, John A.

| Biographical data: | 23.10.1940 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1990-1996 |

Show content of Cryan, John

| Biographical data: | 1960 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2015-18 (Co-Chairman 2015-16, Chairman May 2016 - April 2018) |

Show content of Deichmann, Adolf

| Biographical data: | 27.10.1831 in Cologne - 12.11.1907 in Dresden |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1871 |

The head of the London banking house Horstmann & Co. is not listed, either as a private individual or as a representative of his banking house, on the subscription list that was drawn up at the founding of Deutsche Bank. Nevertheless, he was elected a member of the Supervisory Board at the first General Meeting, but by 1871 he was no longer a member. He came from the Deichmann banking family, the owners of the banking house Deichmann & Co., which was represented on the Supervisory Board by Adolph von Rath and in the subscription of shares by Victor Wendelstadt.

Adolf's father, Wilhelm Deichmann, had married into the Cologne-based Schaaffhausen family in 1830, thus becoming a partner in the trading house and the A. Schaaffhausen'scher Bankverein, which was converted into the first joint-stock bank in Prussia in 1848. He managed the bank for the first decade but voluntarily resigned from its Management Board in 1858 to establish the banking house Deichmann & Co. in Cologne with the aforementioned Adolph von Rath. His connections extended to the largest trading houses, the most renowned banks, and industrialists of Northwest Germany. Adolf Deichmann, Wilhelm's eldest son, became a partner in the London bank Horstmann & Co. after gaining initial experience at the A. Schaaffhausen'scher Bankverein. After his father's death, he remained in London, while his three younger brothers took over the banking business in Germany.

Adolf Deichmann was a Prussian Privy Councillor of Commerce ("Geheimer-Kommerzienrat") and acted in London not only as a banker but also as a diplomat; in 1888, he was elevated to the rank of Baron. He and his wife, Hilda Elizabeth von Bunsen, had connections to the leading political and economic circles of London society.

Show content of Delbrück, Adelbert

| Biographical data: | 16.01.1822 in Magdeburg - 26.05.1890 in Kreuzlingen |  |

| Institution: | Deutsche Bank | |

| Functions: | Chairman of the Supervisory Board 1871-1889 |

The founding of Deutsche Bank is primarily due to the initiative of the banker Adelbert Delbrück. Together with the politician and currency expert Ludwig Bamberger and a banking consortium, he realized the plan in 1870 to create a large institution for financing German foreign trade.

Delbrück, born in Magdeburg in 1822, came from a prominent family of lawyers and theologians who had played an outstanding role in the senior civil service of Prussia and Germany and had produced numerous statesmen, politicians, and scholars. His father, Gottlieb Delbrück, was a lawyer, Privy Senior Government Councillor in Magdeburg, and finally curator of the University of Halle. Adelbert's cousin, Rudolf von Delbrück, had headed the Federal Chancellery since 1867, and the Imperial Chancellery since 1871, and as Bismarck's right-hand man until 1876, played a significant role in the liberal economic policy of the Empire – a family constellation that was certainly not a disadvantage in the founding of Deutsche Bank.

Adelbert Delbrück initially studied theology but then switched to law. Contrary to family tradition, he did not subsequently enter civil service but instead pursued a career in the private sector: He began as a lawyer and legal counsel for a newly founded spinning and weaving mill in Gladbach, before moving to Berlin as a general agent for Concordia Life Insurance Company.

There, in 1854, with the involvement of Rhenish merchants and bankers, he founded the banking house Delbrück Leo & Co. His son Ludwig further expanded the banking house, which merged with the banking house Gebr. Schickler in 1910 to form Delbrück Schickler & Co. 82 years later, one of the partners of this private bank, Hermann Josef Abs, was to join Deutsche Bank as a Management Board member and significantly influence its destiny. In addition to his professional activities, Adelbert Delbrück also held important public offices.

Already involved in the founding of the German Industrial and Commercial Congress in 1861, he headed this body from 1870 to 1885, where the central financial, monetary, and economic policy issues of the time were discussed. In the Senior College of the Berlin Merchants' Association, Delbrück influenced the development and organization of the Berlin Stock Exchange. Furthermore, as a founding member of the German Progressive Party, he was involved in the Berlin City Council, but then declined a candidacy for the Prussian House of Representatives and did not take on any further functions in the party's committees.

Since spring 1869, Adelbert Delbrück had been pursuing the idea "to create a large bank, mainly for overseas trade, which should make us independent of England and the credit facilities that German merchants could only find and seek in London." He initially tried to win over the Berlin banking house Mendelssohn for his idea, but without much success. However, he found a significant supporter for his plans in the cosmopolitan and well-traveled Ludwig Bamberger. He also gained the owners of well-known Berlin banking houses for his project, thereby securing a broad capital base.

The founding committee, formed in early summer 1869, included five other members besides Delbrück. After Delbrück placed particular emphasis on the participation of "one of the leading Berlin banking houses" and Mendelssohn could not be won over, Victor von Magnus, the head of the banking house F. Mart. Magnus, joined the committee and even assumed its chairmanship. From the first General Meeting of Deutsche Bank, Delbrück was elected to the twenty-four-member Administrative Board, from whose midst Victor von Magnus was appointed as the first Chairman of the Administrative Board. In July 1871, he was succeeded in this function by Adelbert Delbrück.

More a theoretician than a practitioner, Delbrück had pursued the founding of Deutsche Bank primarily for economic policy reasons from the outset. When rapid successes in building up the foreign trade business were not forthcoming, the bank sought other ways to earn profits and distribute dividends to shareholders. A continuous conflict between Delbrück and Georg Siemens, the leading figure of the bank's Management, accompanied these strategic questions. A crucial factor was that the stock corporation law at the time made no distinction between the Administrative Board and the Management. The Management was an organ of the Administrative Board and entrusted by it with the management of the business.

Only the stock corporation law amendment of 1884 changed this structure. It drew a clear distinction between the Management (referred to as the Management Board since 1920) and the Administrative Board, whose functions were essentially limited to supervisory activities. The Management Board alone was now responsible for the business. However, Delbrück remained Chairman of the Administrative Board until he had to resign from the body in 1889 due to illness. Under his successor Adolph vom Rath, the Administrative Board was renamed the Supervisory Board.

Show content of Di Iorio, Anthony

| Biographical data: | 1943 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2006-2008 |

Show content of Dobson, Michael

| Biographical data: | 13.05.1952 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1996-2000 |

Show content of Ehret, Robert

| Biographical data: | 19.07.1925 in Mannheim - 02.08.2022 in Königstein i.Ts. |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1970-1985 |

After graduating from high school and military service, Robert Ehret, born in Mannheim in 1925, began studying law and political science in Heidelberg, which he completed with a doctorate in 1949. He held his first professional positions at Fuchs Waggon-Fabrik AG and Süddeutsche Revisions- und Treuhand AG before joining the Süddeutsche Bank Mannheim branch – the temporary successor institution of Deutsche Bank in Southern Germany – in 1953. Appointed Director in 1957, he worked at Deutsche Bank's Munich branch from 1962 to 1966. In 1967, he moved to the corporate headquarters in Frankfurt as a Director with general power of attorney. In 1970, he was appointed to the Management Board of Deutsche Bank, which he left at his own request in May 1985. Subsequently, he was a member of the Supervisory Board until 1993 and then a member of the bank's advisory board until 1995.

Ehret was a proven expert in the securities business and headed Deutsche Bank's stock exchange trading for many years. His expertise also extended to capital markets business. He chaired the administrative board of the bank's Luxembourg subsidiary, which he co-founded, for almost ten years. Ehret provided significant impetus for the restructuring of the Group's mortgage banking business. He held an important industrial mandate as a long-standing member of the Supervisory Board at Bosch.

His early retirement from Deutsche Bank's Management Board at the age of 60 in 1985 was considered unusual, but had been announced and prepared by him long in advance. After leaving active service, Ehret began studying at the Philosophical-Theological University St. Georgen in Frankfurt.

Show content of Eltzbacher, Jacob Löb

| Biographical data: | 07.05.1825 in Neuenkirchen - 04.09.1876 in Mehlem |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1876 |

The Jewish Eltzbacher family founded various merchant and trading companies as well as banking houses in the mid-19th century. Jacob Löb was the second-born and, in 1844, opened the colonial goods and commission business Gebr. Eltzbacher with his older brother in Cologne. In the following years, he founded Eltzbacher & Co. in Amsterdam, of which his younger brother Moritz became the owner; however, the two older brothers acted as partners. This company was primarily responsible for the export and import of the goods traded by the Cologne-based firm Gebr. Eltzbacher. In the 1860s, Eltzbacher began to shift his interests to the banking business, converting his Cologne company into the banking house J.L. Eltzbacher & Co. in 1858, which quickly became one of the most important and active private banks in his hometown.

The connection between the Eltzbacher companies can be seen in the founding of Deutsche Bank. Jacob Löb acquired shares worth 17,800 Talers for his Cologne banking house as one of the last subscribers. Despite a not very high contribution, he was elected to the supervisory board at the first general meeting. He remained a member of the committee until his death. In the first directory of members, he is listed there as a representative of Eltzbacher & Co. from Amsterdam. Due to his entrepreneurial activities and the resulting international relations, Eltzbacher was an interesting partner for Deutsche Bank. His banking house participated in railway financing, as well as in chemical, coal, machinery, and iron production companies. Jacob Löb Eltzbacher also participated with his brother Moritz in the founding of the Amsterdamer Bank.

Show content of Endres, Michael

| Biographical data: | 1937 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1988-1998 |

Show content of Fehr, Selmar

| Biographical data: | 25.03.1874 in Brunswig - 21.06.1934 in Berlin |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1923-1930 |

Selmar Fehr came from a Jewish family of merchants in Braunschweig. He completed a banking apprenticeship at the Berlin private bank S. Fraenkel and joined Deutsche Bank in Berlin in 1899, where he initially worked in trading in shares of mining companies. In 1905 he received power of attorney, became department director in 1912, and deputy director in 1916. During and after the First World War, he devoted himself primarily to questions of bank organisation for the reorganisation of the stock exchange business, which had grown strongly during the inflation period. "Fehr had already acquired the reputation of a skilled arbitrageur and he is said to be particularly familiar with the conditions of the Paris, London and Amsterdam stock exchanges," wrote the Berliner Börsen-Courier. In 1923 he joined the Management Board of Deutsche Bank, succeeding Paul Mankiewitz. Shortly before, he had been elected to the board of the Berlin Stock Exchange. At Deutsche Bank, too, the stock exchange business fell under his responsibility.

In connection with the sharp fall in prices on the Berlin Stock Exchange in May 1927, Deutsche Bank was accused of having been informed in advance and of having misused its insider knowledge for extensive speculation. Fehr in particular is said to have made large short sales for his own account and for Deutsche Bank. Fehr then applied for proceedings against himself before the Court of Honour of the Berlin Stock Exchange. At the same time, an application was filed against him to initiate an investigation. Although both proceedings were dropped, Fehr's continued presence on the Management Board of Deutsche Bank was seen as untenable. In August 1930, he resigned from the Management Board and moved as a partner to the private bank Georg Fromberg & Co., which was closely associated with Deutsche Bank. He remained a member of the Supervisory Board of Deutsche Bank until 1931.

Fehr was Chairman of the supervisory board of NSU-Vereinigte Fahrzeugwerke AG. He also held supervisory board mandates for Eisenbahn-Verkehrsmittel AG, Liquidationskasse AG and Bank des Berliner Cassenvereins.

He was married to Lucie, née Bry, who was related to the German constitutional expert Siegfried Brie (1838-1931). The couple had two sons and one daughter. Fehr donated a motorboat named after his daughter Steffi to the "Ruderklub Deutsche Bank e.V.", which was founded in 1926.

The extent to which Selmar Fehr was personally affected by discrimination under National Socialism is not clear from the available sources. However, when he died in June 1934, his former colleague on the Management Board Oscar Wassermann remarked: "The death of Fehr touches me very deeply. So many people are now dying, literally of a broken heart."

Show content of Feith, Hans

| Biographical data: | 16.04.1910 in Eitorf/Sieg - 03.02.1986 in Frankfurt am Main |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1959-1976 |

After completing his law studies, which he concluded with a doctorate in 1935, and working for several years as a consultant for energy issues in the Reich Ministry of Economics, Feith joined the Berlin headquarters of Deutsche Bank in July 1939. From 1940 to 1945, he was conscripted as a consultant for energy economics to the Ministry of Economics and Labor in Prague. After the end of the war, he returned to Deutsche Bank and initially worked at the Hildesheim branch. His further positions at Deutsche Bank (or its successor institutions) were: authorized signatory in 1947, deputy director of the Munich branch in 1948, director of the Mannheim branch in 1952, and director with general power of attorney at the Frankfurt am Main branch in 1958. In 1959, he was appointed to the Management Board, where he was responsible for the Frankfurt and Mannheim branch districts. At the Frankfurt headquarters, the departments for stock exchange and securities, stock exchange information, Legal Department, and secretariat were under his responsibility.

As a proven stock exchange expert, Feith was a member of the Management Board of the Frankfurt Stock Exchange for many years. He was Chairman of the Committee for Securities and Stock Exchange Matters of the Association of German Banks and a member of the Stock Exchange Expert Commission and the Central Capital Market Committee. His important supervisory board mandates included the chairmanship or deputy chairmanship at AG für Industrie- und Verkehrswesen, Frankfurter Hypothekenbank, Portland-Zementwerke, and Südzucker.

Feith was a member of the Supervisory Board of Deutsche Bank from 1976 to 1985 after his retirement from the Management Board.

Show content of Fischer, Hermann

| Biographical data: | 22.11.1873 in Magdeburg - 24.08.1940 in Berlin |  |

| Institution: | Disconto-Gesellschaft | |

| Functions: | Joint Proprietor 1914-1919, Member of the Supervisory Board 1920-1929, Member of the Supervisory Board of Deutschen Bank and Disconto-Gesellschaft 1929-1931 |

The son of a building contractor from Magdeburg completed his law studies, which he had pursued in Bonn and Strasbourg, with a doctorate in 1899 and established himself as a lawyer in Cologne. At the same time, he taught commercial law as a lecturer at the Cologne School of Commerce. He found his way into practice as legal counsel for A. Schaaffhausen'scher Bankverein in Cologne, on whose behalf he took over the management of Internationale Bohrgesellschaft, Erkelenz, in 1907. After five years of working for this company, he was appointed to the Management Board of Schaaffhausen in 1912. In 1913, he moved to Berlin, where the Cologne bank maintained a branch office of its headquarters. On the occasion of the merger of Disconto-Gesellschaft with Schaaffhausen in 1914, Fischer also joined the board of their proprietors. During the First World War, he was conscripted and deployed to the front as a cavalry captain in the reserves. In 1916, the Prussian Ministry of War appointed him as a consultant for the iron and steel industry. After the war, he worked as a leading consultant in the Ministry for Economic Demobilization.

Fischer voluntarily resigned from the circle of proprietors in 1919 and joined the Supervisory Board of Disconto-Gesellschaft, and from 1929, of Deutsche Bank und Disconto-Gesellschaft, to which he belonged from 1920 to 1931. At the same time, he began to intensify his political activities. Together with Friedrich Naumann and others, he was a member of the provisional executive board of the newly founded left-liberal German Democratic Party (DDP). From 1920 to 1930, he represented the DDP as a member of the Reichstag, where he was particularly active as an expert on tax and budgetary matters. In 1929/30, he served as deputy party chairman of the DDP. In 1922, he was elected President of the Hansabund für Gewerbe, Handel und Industrie. An office he held until 1933, advocating for the least possible state influence on the economy. Fischer criticized the merger of the DDP with the paramilitary Jungdeutscher Orden and the Volksnationale Reichsvereinigung to form the German State Party (DStP), but remained a member of the Reichstag for the DStP. His efforts to form a new liberal, bourgeois party that would oppose the growing influence of the NSDAP failed. After the National Socialists seized power, Fischer was briefly placed in "protective custody". Afterward, he was able to work as a lawyer and notary in Berlin, but remained under observation by the National Socialist Security Service as a "leading man of the system era".

Show content of Fischer, Paul David

| Biographical data: | 02.06.1836 in Berlin - 13.03.1920 in Berlin |  |

| Institution: | Disconto-Gesellschaft | |

| Functions: | Member of the Supervisory Board 1899-1902, Chairman of the Supervisory Board 1902-1920 |

The Disconto-Gesellschaft frequently recruited leading figures for its management from the ranks of high-ranking civil servants and administrative lawyers. Among them was Paul David Fischer, who was entrusted with the leading position on the bank's supervisory board for almost 20 years. After attending grammar school, Fischer studied law at the universities in Berlin and Bonn and entered the Prussian judicial service in 1858. Appointed to the General Post Office of the North German Confederation in spring 1867, he became one of the most important collaborators and confidants of State Secretary Heinrich von Stephan in a collaboration spanning almost thirty years. After Stephan's death in 1897, he retired from imperial service as Undersecretary of State and Privy Councillor. He joined the Disconto-Gesellschaft in 1899, when Adolph von Hansemann appointed him to the management of the Shantung companies, and he was simultaneously elected to the bank's supervisory board at the general meeting on March 27, 1899. Here he took over the chairmanship in 1902, which he held until his death.

Show content of Fischer, Thomas R.

| Biographical data: | 1947 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 1999 - 2002 |

Show content of Fitschen, Jürgen

| Biographical data: | 1948 |

| Institution: | Deutsche Bank |

| Functions: | Member of the Management Board 2001-2002 and 2009-2016 (Co-CEO 2012-2016) |

Show content of Frank, Theodor

| Biographical data: | 10.04.1871 in Grethen/Pfalz - 28.10.1953 in Zurich |  |

| Institution: | Disconto-Gesellschaft / Deutsche Bank | |

| Functions: | Joint Proprietor / Member of the Management Board 1922-1933 |

Theodor Frank came from a Jewish merchant family. He began his banking career in 1886 in a private bank in Karlsruhe, which he left after completing his apprenticeship to become an employee of W. H. Ladenburg & Söhne, Mannheim. The owner, Karl Ladenburg, recognised Frank's abilities early on and made him his private secretary. He was called in to take minutes at the supervisory board meetings of large companies and was given procuration soon after joining the company.

Frank was already involved in the transformation of Bankhaus Ladenburg into Süddeutsche Disconto-Gesellschaft in 1905. He first became deputy director at the new bank and shortly afterwards a member of the board of directors. Frank's many relationships with southern German industrial companies - for example with Rheinau Aktiengesellschaft, Oberrheinische Eisenbahn-Gesellschaft or later Süddeutsche Zucker AG (Südzucker) - stemmed from his work for Süddeutsche Disconto-Gesellschaft which lasted until 1922. Very soon he moved up to become a full member of the executive board. The upswing of the Süddeutsche Disconto-Gesellschaft was largely due to Frank. His services to the Baden economy were recognised in his appointment as a Kommerzienrat and later in the award of an honorary doctorate from the University of Heidelberg. When he became joint proprietor of Disconto-Gesellschaft in 1922, he brought his rich southern German experience to his new sphere of activity. This made it easier for both the Disconto-Gesellschaft and from 1929 the merged businesses of Deutsche Bank und Disconto-Gesellschaft to gain a foothold in southwest Germany. His other duties included supervising the bank's stock exchange department.

In 1933 Frank, together with Wassermann and Solmssen, was one of the board members who had to leave the bank because of their Jewish origins. Until 1936 he was still deputy chairman of the advisory board Berlin-Brandenburg of Deutsche Bank. He had to give up his supervisory board mandates by 1938.

Frank emigrated first to Belgium, then to southern France. During the war, he escaped arrest in Nice only by chance, while his wife Margot was deported and murdered. Frank spent the last years of his life in modest circumstances in France, Italy and Switzerland.

Show content of Frege, Martin

| Biographical data: | 1834 - unknown |

| Institution: | Deutsche Bank |

| Functions: | Member of the Administrative Board 1870-1874 |

Martin Frege was a partner in the Leipzig banking house Frege & Co. in the late 1860s and early 1870s. The banking house originated in trade and had been founded in 1739 by Christian Gottlob Frege. While initially focusing on the trade of goods, commission business and the granting of loans became an important source of income from the mid-18th century onwards. The trading house combined trade in goods, freight forwarding, investments in real estate, and banking in a single company, thus maintaining a wide range of relationships that extended abroad. In addition to a branch in Berlin, the banking house also had a presence in Marseille. The banking house was only marginally involved in industrial financing and therefore lost importance from the mid-19th century onwards. Martin Frege was part of the Wismar family line, which had temporarily been in conflict with the Leipzig branch after the death of the company founder due to unregulated succession. However, this dispute no longer stood in the way of Martin Frege joining the Leipzig banking house.

Frege was a member of the Administrative Board from the very beginning and subscribed the sum of 70,600 thalers for his banking house at the founding of Deutsche Bank. In 1874, he resigned from the Administrative Board, possibly leaving the banking house Frege & Co. around the same time.

Show content of Frowein, Robert

| Biographical data: | 04.01.1893 in Remscheid - 22.12.1958 in Frankfurt am Main |  |

| Institution: | Deutsche Bank | |

| Functions: | Member of the Management Board 1943-1945 and 1957-1958 |

Frowein came from a manufacturing family in Remscheid. After school, he initially worked for a short time at Bergisch-Märkische Bank in Kronenberg from 1912, before beginning law studies, which he completed with a doctorate in 1920, with an interruption during the First World War. After banking training at the Deutsche Bank branch (Solingen-) Wald, he joined the branch office of the Berlin headquarters in 1921, where he received power of attorney a year later. From 1926, Frowein worked in the headquarters secretariat, became deputy director in 1932, and went to Saarbrücken in 1933 as branch manager of Deutsche Bank. In 1938, he took over the management of the Frankfurt am Main branch. In 1943, he was appointed to the Management Board of Deutsche Bank, to which he belonged until the end of the war and where he was responsible for the Silesian branch division. Although Frowein had been a member of the Nazi Party since 1936, he continued to manage the business of the Frankfurt branch even after his appointment to the bank's top management, rarely came to Berlin, and was therefore "hardly an effective reinforcement of the National Socialist presence on the Management Board of Deutsche Bank" (Harold James), which was sought by the party.

At the end of the war, he was arrested by the Russians and interned in various camps until mid-1948. In 1949, he joined the management of Hessische Bank, one of the ten successor institutions of Deutsche Bank, which became Süddeutsche Bank in 1952. After the re-establishment of Deutsche Bank, he again belonged to its Management Board until his death. Frowein's important mandates included the chairmanship of the Supervisory Board at Didier-Werke and the chairmanship of the Administrative Board at Otavi-Minen AG.